CFA Level 3 v1.0

Question 1

Hilda Olson covers the chemical industry for Bern Securities. Based on conversations with two executives of InterChem, a major producer of synthetic fabrics, she issues a generalized sector report claiming that "according to a survey of industry executives, rayon feedstocks will be in short supply for at least the next 12 months." In addition, Olson recommends Han Chemical, a major producer of rayon, which has routinely reported higher profits than its competitors and should be well positioned to gain further from reduced supply.

In her efforts to learn more about Han Chemical and support her recommendation, Olson scrambles to compile a research report on the firm. She reproduces financial data provided in a research report by Standard & Poor's (S&P) and the Bank of Korea (BOK), the Korean government's central bank. She also obtains two research reports from brokerage firms with operations in Korea, and incorporates portions of the text and charts from these reports into her research report.

Olson describes Han Chemical in her research report as "low risk," even though she knows that the operating risk of the chemical industry is above average and that Han has a higher debt-to-equity ratio than its average competitor. She justifies this to her supervisor by saying that since the market for rayon feedstocks is tight, an investment in Han has a very low risk of suffering a loss in the near term. Olson's supervisor accepts her explanation as valid and the report is issued to the firm's clients.

Shortly after issuing her research report, Olson visited Han Chemical's operations in New Jersey. During her conversation with the firm's vice president of operations, who is also one of Bern's personal trust clients, she was told in confidence that Han Chemical's profit margins are higher than its competitors, partly because they routinely discharge untreated chemical waste into the Delaware River in order to reduce production costs. Such action is a direct violation of U.S. environmental laws.

When Olson returns from her trip to New Jersey, Wolfgang Hundt, director of research at Bern Securities, requests a meeting. Hundt has developed a compliance procedure and has provided relevant written information to employees. Every quarter, he issues written reminders regarding the program to Olson and her peers, so when Olson tells Hundt of Han's chemical dumping, he immediately begins an investigation into the violation.

With regard to the statement concerning rayon feedstocks, Olson has:

- A. not violated CFA Institute Standards.

- B. violated CFA Institute Standards since she has failed to use reasonable judgment in gathering her information.

- C. violated CFA Institute Standards since she is not permitted to project supply and demand conditions in the industry.

Answer : B

Explanation:

Olson has failed to exercise due diligence and form a reasonable basis for her statement regarding rayon feedstocks. She has used information from two executives at one company in the industry to draw conclusions about the overall market. This does not reflect the thoroughness required by Standard V(A)

Diligence and Reasonable Basis and thus Olson has violated the Standard. In addition, she may have violated Standard V(B) Communication with Clients and

Prospective Clients by failing to distinguish between opinion and fact in her research report. (Study Session 1, LOS I.b)

Question 2

Hilda Olson covers the chemical industry for Bern Securities. Based on conversations with two executives of InterChem, a major producer of synthetic fabrics, she issues a generalized sector report claiming that "according to a survey of industry executives, rayon feedstocks will be in short supply for at least the next 12 months." In addition, Olson recommends Han Chemical, a major producer of rayon, which has routinely reported higher profits than its competitors and should be well positioned to gain further from reduced supply.

In her efforts to learn more about Han Chemical and support her recommendation, Olson scrambles to compile a research report on the firm. She reproduces financial data provided in a research report by Standard & Poor's (S&P) and the Bank of Korea (BOK), the Korean government's central bank. She also obtains two research reports from brokerage firms with operations in Korea, and incorporates portions of the text and charts from these reports into her research report.

Olson describes Han Chemical in her research report as "low risk," even though she knows that the operating risk of the chemical industry is above average and that Han has a higher debt-to-equity ratio than its average competitor. She justifies this to her supervisor by saying that since the market for rayon feedstocks is tight, an investment in Han has a very low risk of suffering a loss in the near term. Olson's supervisor accepts her explanation as valid and the report is issued to the firm's clients.

Shortly after issuing her research report, Olson visited Han Chemical's operations in New Jersey. During her conversation with the firm's vice president of operations, who is also one of Bern's personal trust clients, she was told in confidence that Han Chemical's profit margins are higher than its competitors, partly because they routinely discharge untreated chemical waste into the Delaware River in order to reduce production costs. Such action is a direct violation of U.S. environmental laws.

When Olson returns from her trip to New Jersey, Wolfgang Hundt, director of research at Bern Securities, requests a meeting. Hundt has developed a compliance procedure and has provided relevant written information to employees. Every quarter, he issues written reminders regarding the program to Olson and her peers, so when Olson tells Hundt of Han's chemical dumping, he immediately begins an investigation into the violation.

In her report on Han Chemical, Olson has utilized data from S&P and the BOK. With regard to this data, Olson is allowed to use:

- A. both sources of data, but must acknowledge the sources of the data.

- B. both sources of data, and need not acknowledge the sources of the data.

- C. the S&P data, but not the BOK data, and she must acknowledge the source.

Answer : B

Explanation:

According to CFA Institute Standard 1(C) Misrepresentation, members and candidates are allowed to utilize factual information and data published by well-known entities that report financial and statistical information or other sources that are similar without providing citations of these sources. Widely published data from

S&P and the central bank of the Korean government would fall into this category. (Study Session 1, LOS l.b)

Question 3

Hilda Olson covers the chemical industry for Bern Securities. Based on conversations with two executives of InterChem, a major producer of synthetic fabrics, she issues a generalized sector report claiming that "according to a survey of industry executives, rayon feedstocks will be in short supply for at least the next 12 months." In addition, Olson recommends Han Chemical, a major producer of rayon, which has routinely reported higher profits than its competitors and should be well positioned to gain further from reduced supply.

In her efforts to learn more about Han Chemical and support her recommendation, Olson scrambles to compile a research report on the firm. She reproduces financial data provided in a research report by Standard & Poor's (S&P) and the Bank of Korea (BOK), the Korean government's central bank. She also obtains two research reports from brokerage firms with operations in Korea, and incorporates portions of the text and charts from these reports into her research report.

Olson describes Han Chemical in her research report as "low risk," even though she knows that the operating risk of the chemical industry is above average and that Han has a higher debt-to-equity ratio than its average competitor. She justifies this to her supervisor by saying that since the market for rayon feedstocks is tight, an investment in Han has a very low risk of suffering a loss in the near term. Olson's supervisor accepts her explanation as valid and the report is issued to the firm's clients.

Shortly after issuing her research report, Olson visited Han Chemical's operations in New Jersey. During her conversation with the firm's vice president of operations, who is also one of Bern's personal trust clients, she was told in confidence that Han Chemical's profit margins are higher than its competitors, partly because they routinely discharge untreated chemical waste into the Delaware River in order to reduce production costs. Such action is a direct violation of U.S. environmental laws.

When Olson returns from her trip to New Jersey, Wolfgang Hundt, director of research at Bern Securities, requests a meeting. Hundt has developed a compliance procedure and has provided relevant written information to employees. Every quarter, he issues written reminders regarding the program to Olson and her peers, so when Olson tells Hundt of Han's chemical dumping, he immediately begins an investigation into the violation.

In her report on Han Chemical, Olson has also utilized two brokerage firms' reports. With regard to these sources, Olson is:

- A. allowed to use the text and charts, but must acknowledge the sources.

- B. allowed to use the text and charts, and need not acknowledge the sources.

- C. not allowed to use the text and charts from other reports. A

Answer : Explanation

Explanation:

Under CFA Institute Standard 1(C) Misrepresentation, members and candidates are required to acknowledge the sources of information that they incorporate into their own work that do not originate from a recognized financial/statistical reporting service. Therefore, Olson must properly cite the information obtained from the brokerage reports in order to comply with Standard 1(C). (Study Session 1, LOS l.b)

Question 4

Hilda Olson covers the chemical industry for Bern Securities. Based on conversations with two executives of InterChem, a major producer of synthetic fabrics, she issues a generalized sector report claiming that "according to a survey of industry executives, rayon feedstocks will be in short supply for at least the next 12 months." In addition, Olson recommends Han Chemical, a major producer of rayon, which has routinely reported higher profits than its competitors and should be well positioned to gain further from reduced supply.

In her efforts to learn more about Han Chemical and support her recommendation, Olson scrambles to compile a research report on the firm. She reproduces financial data provided in a research report by Standard & Poor's (S&P) and the Bank of Korea (BOK), the Korean government's central bank. She also obtains two research reports from brokerage firms with operations in Korea, and incorporates portions of the text and charts from these reports into her research report.

Olson describes Han Chemical in her research report as "low risk," even though she knows that the operating risk of the chemical industry is above average and that Han has a higher debt-to-equity ratio than its average competitor. She justifies this to her supervisor by saying that since the market for rayon feedstocks is tight, an investment in Han has a very low risk of suffering a loss in the near term. Olson's supervisor accepts her explanation as valid and the report is issued to the firm's clients.

Shortly after issuing her research report, Olson visited Han Chemical's operations in New Jersey. During her conversation with the firm's vice president of operations, who is also one of Bern's personal trust clients, she was told in confidence that Han Chemical's profit margins are higher than its competitors, partly because they routinely discharge untreated chemical waste into the Delaware River in order to reduce production costs. Such action is a direct violation of U.S. environmental laws.

When Olson returns from her trip to New Jersey, Wolfgang Hundt, director of research at Bern Securities, requests a meeting. Hundt has developed a compliance procedure and has provided relevant written information to employees. Every quarter, he issues written reminders regarding the program to Olson and her peers, so when Olson tells Hundt of Han's chemical dumping, he immediately begins an investigation into the violation.

Olson's characterization of the risks associated with an investment in Han Chemical is:

- A. acceptable since it is clearly an opinion.

- B. acceptable since it is supported with facts regarding industry supply and demand.

- C. unacceptable since she has not provided enough information for investors to assess Han's risk.

Answer : C

Explanation:

Olson's report mischaracterizes the level of risk inherent in the investment. As such, this constitutes a violation of Standard V(B) Communication with Clients and

Prospective Clients. Olson has also violated Standard 1(C) Misrepresentation by misleading investors as to the true nature of the risk associated with an investment in Han Chemical. (Study Session L, LOS l.b)

Question 5

Hilda Olson covers the chemical industry for Bern Securities. Based on conversations with two executives of InterChem, a major producer of synthetic fabrics, she issues a generalized sector report claiming that "according to a survey of industry executives, rayon feedstocks will be in short supply for at least the next 12 months." In addition, Olson recommends Han Chemical, a major producer of rayon, which has routinely reported higher profits than its competitors and should be well positioned to gain further from reduced supply.

In her efforts to learn more about Han Chemical and support her recommendation, Olson scrambles to compile a research report on the firm. She reproduces financial data provided in a research report by Standard & Poor's (S&P) and the Bank of Korea (BOK), the Korean government's central bank. She also obtains two research reports from brokerage firms with operations in Korea, and incorporates portions of the text and charts from these reports into her research report.

Olson describes Han Chemical in her research report as "low risk," even though she knows that the operating risk of the chemical industry is above average and that Han has a higher debt-to-equity ratio than its average competitor. She justifies this to her supervisor by saying that since the market for rayon feedstocks is tight, an investment in Han has a very low risk of suffering a loss in the near term. Olson's supervisor accepts her explanation as valid and the report is issued to the firm's clients.

Shortly after issuing her research report, Olson visited Han Chemical's operations in New Jersey. During her conversation with the firm's vice president of operations, who is also one of Bern's personal trust clients, she was told in confidence that Han Chemical's profit margins are higher than its competitors, partly because they routinely discharge untreated chemical waste into the Delaware River in order to reduce production costs. Such action is a direct violation of U.S. environmental laws.

When Olson returns from her trip to New Jersey, Wolfgang Hundt, director of research at Bern Securities, requests a meeting. Hundt has developed a compliance procedure and has provided relevant written information to employees. Every quarter, he issues written reminders regarding the program to Olson and her peers, so when Olson tells Hundt of Han's chemical dumping, he immediately begins an investigation into the violation.

With regard to the information Olson received from Han Chemical's Vice President of Operations, the most appropriate course of action for Olson to take would be to:

- A. not divulge such information in her client research since she now lacks independence and objectivity.

- B. divulge the information to her employer because, even though received in confidence, it involves an illegal act.

- C. divulge the information in her client's research department in order to demonstrate due diligence in performing her research.

Answer : B

Explanation:

In most cases, it would be a violation of CFA Institute Standards to divulge information, which was transmitted in confidence. However, under Standard III(E)

Preservation of Confidentiality, an exception is made for information pertaining to an illegal act. Especially since she has issued a research report and buy order for Han, she is compelled under the Standard to divulge such information. She should address the matter with Bern's chief compliance officer as the first step in the process. (Study Session 1, LOS Lb)

Question 6

Hilda Olson covers the chemical industry for Bern Securities. Based on conversations with two executives of InterChem, a major producer of synthetic fabrics, she issues a generalized sector report claiming that "according to a survey of industry executives, rayon feedstocks will be in short supply for at least the next 12 months." In addition, Olson recommends Han Chemical, a major producer of rayon, which has routinely reported higher profits than its competitors and should be well positioned to gain further from reduced supply.

In her efforts to learn more about Han Chemical and support her recommendation, Olson scrambles to compile a research report on the firm. She reproduces financial data provided in a research report by Standard & Poor's (S&P) and the Bank of Korea (BOK), the Korean government's central bank. She also obtains two research reports from brokerage firms with operations in Korea, and incorporates portions of the text and charts from these reports into her research report.

Olson describes Han Chemical in her research report as "low risk," even though she knows that the operating risk of the chemical industry is above average and that Han has a higher debt-to-equity ratio than its average competitor. She justifies this to her supervisor by saying that since the market for rayon feedstocks is tight, an investment in Han has a very low risk of suffering a loss in the near term. Olson's supervisor accepts her explanation as valid and the report is issued to the firm's clients.

Shortly after issuing her research report, Olson visited Han Chemical's operations in New Jersey. During her conversation with the firm's vice president of operations, who is also one of Bern's personal trust clients, she was told in confidence that Han Chemical's profit margins are higher than its competitors, partly because they routinely discharge untreated chemical waste into the Delaware River in order to reduce production costs. Such action is a direct violation of U.S. environmental laws.

When Olson returns from her trip to New Jersey, Wolfgang Hundt, director of research at Bern Securities, requests a meeting. Hundt has developed a compliance procedure and has provided relevant written information to employees. Every quarter, he issues written reminders regarding the program to Olson and her peers, so when Olson tells Hundt of Han's chemical dumping, he immediately begins an investigation into the violation.

Olson is concerned that Hundt's compliance actions as director of the firm's research department are inconsistent with CFA Institute Standards. Which of the following properly characterize Hundt's compliance activities? Hundt's actions are:

- A. consistent with CFA Institute Standards.

- B. improper with respect to both the investigation procedures and the periodic reminders.

- C. improper regarding the periodic reminders, as these do not constitute regular training. A

Answer : Explanation

Explanation:

All of Hundt's actions are consistent with CFA Institute Standard IV(C) Responsibilities of Supervisors. According to this Standard, supervisors exercise reasonable supervision by ensuring that employees follow the written compliance procedures established by their supervisor. Supervisors have a responsibility to disseminate the compliance procedures to employees and it is recommended that they regularly update procedures and continually educate personnel subject to the procedures- If a supervisor knows of a violation, he or she must promptly begin an investigation into the matter. (Study Session 1, LOS l.b)

Sample Scoring Key: 3 points for each correct response.

Question 7

Dynamic Investment Services (DIS) is a global, full-service investment advisory firm based in the United States. Although the firm provides numerous investment services, DIS specializes in portfolio management for individual and institutional clients and only deals in publicly traded debt, equity, and derivative instruments.

Walter Fried, CFA, is a portfolio manager and the director of DIS's offices in Austria. For several years, Fried has maintained a relationship with a local tax consultant. The consultant provides a DIS marketing brochure with Fried's contact information to his clients seeking investment advisory services, and in return.

Fried manages the consultant's personal portfolio and informs the consultant of potential tax issues in the referred clients' portfolios as they occur. Because he cannot personally manage all of the inquiring clients' assets, Fried generally passes the client information along to one of his employees but never discloses his relationship with the tax accountant. Fried recently forwarded information on the prospective Jones Family Trust account to Beverly Ulster, CFA, one of his newly hired portfolio managers.

Upon receiving the information, Ulster immediately set up a meeting with Terrence Phillips, the trustee of the Jones Family Trust. Ulster began the meeting by explaining DIS's investment services as detailed in the firm's approved marketing and public relations literature. Ulster also had Phillips complete a very detailed questionnaire regarding the risk and return objectives, investment constraints, and other information related to the trust beneficiaries, which Phillips is not. While reading the questionnaire, Ulster learned that Phillips heard about DIS's services through a referral from his tax consultant. Upon further investigation, Ulster discovered the agreement set up between Fried and the tax consultant, which is legal according to Austrian law but was not disclosed by either party Ulster took a break from the meeting to get more details from Fried. With full information on the referral arrangement, Ulster immediately makes full disclosure to the Phillips.

Before the meeting with Phillips concluded, Ulster began formalizing the investment policy statement (IPS) for the Jones Family Trust and agreed to Phillips' request that the IPS should explicitly forbid derivative positions in the Trust portfolio.

A few hours after meeting with the Jones Family Trust representative, Ulster accepted another new referral client, Steven West, from Fried. Following DIS policy,

Ulster met with West to address his investment objectives and constraints and explain the firm's services. During the meeting, Ulster informed West that DIS offers three levels of account status, each with an increasing fee based on the account's asset value. The first level has the lowest account fees but receives oversubscribed domestic IPO allocations only after the other two levels receive IPO allocations. The second-level clients have the same priority as third-level clients with respect to oversubscribed domestic IPO allocations and receive research with significantly greater detail than first-level clients. Clients who subscribe to the third level of DIS services receive the most detailed research reports and are allowed to participate in both domestic and international IPOs. All clients receive research and recommendations at approximately the same lime. West decided to engage DIS's services as a second-level client. While signing the enrollment papers, West told Ulster, "If you can give me the kind of performance I am looking for, I may move the rest of my assets to DIS." When Ulster inquired about the other accounts, West would not specify how much or what type of assets he held in other accounts. West also noted that a portion of the existing assets to be transferred to Ulster's control were private equity investments in small start-up companies, which DIS would need to manage. Ulster assured him that DIS would have no problem managing the private equity investments.

After her meeting with West, Ulster attended a weekly strategy session held by DIS. All managers were required to attend this particular meeting since the focus was on a new strategy designed to reduce portfolio volatility while slightly enhancing return using a combination of futures and options on various asset classes.

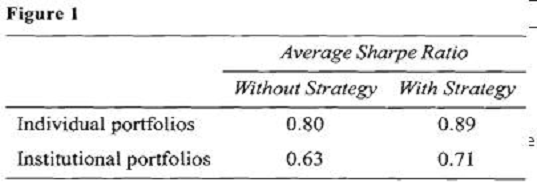

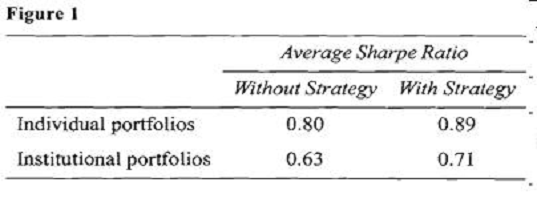

Intrigued by the idea, Ulster implemented the strategy for all of her clients and achieved positive results for all portfolios. Ulster's average performance results after one year of using the new strategy are presented in Figure 1. For comparative purposes, performance figures without the new strategy are also presented.

At the latest strategy meeting, DIS economists were extremely pessimistic about emerging market economies and suggested that the firm's portfolio managers consider selling emerging market securities out of their portfolios and avoid these investments for the next 12 to 15 months. Fried placed a limit order to sell his personal holdings of an emerging market fund at a price 5% higher than the market price at the time. He then began selling his clients' (all of whom have discretionary accounts with DIS) holdings of the same emerging market fund using market orders. All of his clients' trade orders were completed just before the price of the fund declined sharply by 13%, causing Fried's order to remain unfilled.

Did Ulster violate CFA Institute Standards of Professional Conduct by accepting either Phillips or West as new clients?

- A. Standards were violated in accepting both Phillips and West as clients.

- B. There was no violation in accepting Phillips, but there was a violation in accepting West.

- C. There were no Standards violations in accepting either client.

Answer : B

Explanation:

Ai the time Ulster accepted Phillips (and the Jones Family Trust) as a client, she was unaware of the referral arrangement between Fried and the tax consultant. In addition, Ulster informed the client of the referral agreement terms after being fully briefed on the matter. No other information in the case indicates that her acceptance of Phillips as a client violated the Standards. Given the full disclosure, it is understood that Phillips approves of Fried's need to periodically advise the tax consultant of potential tax issues relating to the client's portfolio. After discovering, however, that Fried has been violating Standard V1(C) Referral Fees by not disclosing the arrangement with the tax consultant, she should not have accepted additional clients from Fried. Standard 1(A) Knowledge of the Law requires that members and candidates not knowingly participate or assist in any activity that violates applicable law, rules, and regulations, including the Code and Standards. If a member or candidate knows of a violation, they must dissociate from the activity. Members and candidates may find it necessary to report the violation to their supervisor or compliance officer as part of their attempt to dissociate from the violating activity. By accepting West as a client, Ulster has violated Standard 1(A).

(Study Session l,LOS2.a)

Question 8

Dynamic Investment Services (DIS) is a global, full-service investment advisory firm based in the United States. Although the firm provides numerous investment services, DIS specializes in portfolio management for individual and institutional clients and only deals in publicly traded debt, equity, and derivative instruments.

Walter Fried, CFA, is a portfolio manager and the director of DIS's offices in Austria. For several years, Fried has maintained a relationship with a local tax consultant. The consultant provides a DIS marketing brochure with Fried's contact information to his clients seeking investment advisory services, and in return.

Fried manages the consultant's personal portfolio and informs the consultant of potential tax issues in the referred clients' portfolios as they occur. Because he cannot personally manage all of the inquiring clients' assets, Fried generally passes the client information along to one of his employees but never discloses his relationship with the tax accountant. Fried recently forwarded information on the prospective Jones Family Trust account to Beverly Ulster, CFA, one of his newly hired portfolio managers.

Upon receiving the information, Ulster immediately set up a meeting with Terrence Phillips, the trustee of the Jones Family Trust. Ulster began the meeting by explaining DIS's investment services as detailed in the firm's approved marketing and public relations literature. Ulster also had Phillips complete a very detailed questionnaire regarding the risk and return objectives, investment constraints, and other information related to the trust beneficiaries, which Phillips is not. While reading the questionnaire, Ulster learned that Phillips heard about DIS's services through a referral from his tax consultant. Upon further investigation, Ulster discovered the agreement set up between Fried and the tax consultant, which is legal according to Austrian law but was not disclosed by either party Ulster took a break from the meeting to get more details from Fried. With full information on the referral arrangement, Ulster immediately makes full disclosure to the Phillips.

Before the meeting with Phillips concluded, Ulster began formalizing the investment policy statement (IPS) for the Jones Family Trust and agreed to Phillips' request that the IPS should explicitly forbid derivative positions in the Trust portfolio.

A few hours after meeting with the Jones Family Trust representative, Ulster accepted another new referral client, Steven West, from Fried. Following DIS policy,

Ulster met with West to address his investment objectives and constraints and explain the firm's services. During the meeting, Ulster informed West that DIS offers three levels of account status, each with an increasing fee based on the account's asset value. The first level has the lowest account fees but receives oversubscribed domestic IPO allocations only after the other two levels receive IPO allocations. The second-level clients have the same priority as third-level clients with respect to oversubscribed domestic IPO allocations and receive research with significantly greater detail than first-level clients. Clients who subscribe to the third level of DIS services receive the most detailed research reports and are allowed to participate in both domestic and international IPOs. All clients receive research and recommendations at approximately the same lime. West decided to engage DIS's services as a second-level client. While signing the enrollment papers, West told Ulster, "If you can give me the kind of performance I am looking for, I may move the rest of my assets to DIS." When Ulster inquired about the other accounts, West would not specify how much or what type of assets he held in other accounts. West also noted that a portion of the existing assets to be transferred to Ulster's control were private equity investments in small start-up companies, which DIS would need to manage. Ulster assured him that DIS would have no problem managing the private equity investments.

After her meeting with West, Ulster attended a weekly strategy session held by DIS. All managers were required to attend this particular meeting since the focus was on a new strategy designed to reduce portfolio volatility while slightly enhancing return using a combination of futures and options on various asset classes.

Intrigued by the idea, Ulster implemented the strategy for all of her clients and achieved positive results for all portfolios. Ulster's average performance results after one year of using the new strategy are presented in Figure 1. For comparative purposes, performance figures without the new strategy are also presented.

At the latest strategy meeting, DIS economists were extremely pessimistic about emerging market economies and suggested that the firm's portfolio managers consider selling emerging market securities out of their portfolios and avoid these investments for the next 12 to 15 months. Fried placed a limit order to sell his personal holdings of an emerging market fund at a price 5% higher than the market price at the time. He then began selling his clients' (all of whom have discretionary accounts with DIS) holdings of the same emerging market fund using market orders. All of his clients' trade orders were completed just before the price of the fund declined sharply by 13%, causing Fried's order to remain unfilled.

Does the referral agreement between Fried and the tax consultant violate any CFA Institute Standards of Professional Conduct?

- A. No.

- B. Yes, because client confidentiality is being undermined by the arrangement.

- C. Yes, because it involves non-monetary compensation with no observable cost.

Answer : B

Explanation:

As part of the referral arrangement, Fried is obligated to inform the tax consultant of potential tax issues that arise as a result of managing the portfolios of the referred clients. This is a violation of Standard III(E) Preservation of Confidentiality. Members and candidates are required to keep client information (such as tax status) confidential unless the information involves illegal activities, in which case the member or candidate may have a legal obligation 10 disclose the information. This is an especially relevant issue in this case since the referral arrangement has not been disclosed and the client has had no opportunity to allow or refuse the communication of her portfolio tax status to the consultant. (Study Session 1, LOS 2.a)

Question 9

Dynamic Investment Services (DIS) is a global, full-service investment advisory firm based in the United States. Although the firm provides numerous investment services, DIS specializes in portfolio management for individual and institutional clients and only deals in publicly traded debt, equity, and derivative instruments.

Walter Fried, CFA, is a portfolio manager and the director of DIS's offices in Austria. For several years, Fried has maintained a relationship with a local tax consultant. The consultant provides a DIS marketing brochure with Fried's contact information to his clients seeking investment advisory services, and in return.

Fried manages the consultant's personal portfolio and informs the consultant of potential tax issues in the referred clients' portfolios as they occur. Because he cannot personally manage all of the inquiring clients' assets, Fried generally passes the client information along to one of his employees but never discloses his relationship with the tax accountant. Fried recently forwarded information on the prospective Jones Family Trust account to Beverly Ulster, CFA, one of his newly hired portfolio managers.

Upon receiving the information, Ulster immediately set up a meeting with Terrence Phillips, the trustee of the Jones Family Trust. Ulster began the meeting by explaining DIS's investment services as detailed in the firm's approved marketing and public relations literature. Ulster also had Phillips complete a very detailed questionnaire regarding the risk and return objectives, investment constraints, and other information related to the trust beneficiaries, which Phillips is not. While reading the questionnaire, Ulster learned that Phillips heard about DIS's services through a referral from his tax consultant. Upon further investigation, Ulster discovered the agreement set up between Fried and the tax consultant, which is legal according to Austrian law but was not disclosed by either party Ulster took a break from the meeting to get more details from Fried. With full information on the referral arrangement, Ulster immediately makes full disclosure to the Phillips.

Before the meeting with Phillips concluded, Ulster began formalizing the investment policy statement (IPS) for the Jones Family Trust and agreed to Phillips' request that the IPS should explicitly forbid derivative positions in the Trust portfolio.

A few hours after meeting with the Jones Family Trust representative, Ulster accepted another new referral client, Steven West, from Fried. Following DIS policy,

Ulster met with West to address his investment objectives and constraints and explain the firm's services. During the meeting, Ulster informed West that DIS offers three levels of account status, each with an increasing fee based on the account's asset value. The first level has the lowest account fees but receives oversubscribed domestic IPO allocations only after the other two levels receive IPO allocations. The second-level clients have the same priority as third-level clients with respect to oversubscribed domestic IPO allocations and receive research with significantly greater detail than first-level clients. Clients who subscribe to the third level of DIS services receive the most detailed research reports and are allowed to participate in both domestic and international IPOs. All clients receive research and recommendations at approximately the same lime. West decided to engage DIS's services as a second-level client. While signing the enrollment papers, West told Ulster, "If you can give me the kind of performance I am looking for, I may move the rest of my assets to DIS." When Ulster inquired about the other accounts, West would not specify how much or what type of assets he held in other accounts. West also noted that a portion of the existing assets to be transferred to Ulster's control were private equity investments in small start-up companies, which DIS would need to manage. Ulster assured him that DIS would have no problem managing the private equity investments.

After her meeting with West, Ulster attended a weekly strategy session held by DIS. All managers were required to attend this particular meeting since the focus was on a new strategy designed to reduce portfolio volatility while slightly enhancing return using a combination of futures and options on various asset classes.

Intrigued by the idea, Ulster implemented the strategy for all of her clients and achieved positive results for all portfolios. Ulster's average performance results after one year of using the new strategy are presented in Figure 1. For comparative purposes, performance figures without the new strategy are also presented.

At the latest strategy meeting, DIS economists were extremely pessimistic about emerging market economies and suggested that the firm's portfolio managers consider selling emerging market securities out of their portfolios and avoid these investments for the next 12 to 15 months. Fried placed a limit order to sell his personal holdings of an emerging market fund at a price 5% higher than the market price at the time. He then began selling his clients' (all of whom have discretionary accounts with DIS) holdings of the same emerging market fund using market orders. All of his clients' trade orders were completed just before the price of the fund declined sharply by 13%, causing Fried's order to remain unfilled.

During her initial meeting with West, did Ulster violate any CFA Institute Standards of Professional Conduct?

- A. Yes.

- B. No, because she developed a detailed investment policy to ensure the suitability of investment choices for the client's account.

- C. No, because she ensured that all conflicts of interest were disclosed to the client before the investment policy statement was created.

Answer : A

Explanation:

During the meeting, Ulster describes the services the firm can provide. However, she neglected to mention that her firm has no experience managing private equity investments and even assures West that DIS will have no problem managing this portion of the portfolio. Thus, Ulster has misrepresented the services that her firm can provide to the client in violation of Standard 1(C) Misrepresentation. (Study Session 1, LOS 2.a)

Question 10

Dynamic Investment Services (DIS) is a global, full-service investment advisory firm based in the United States. Although the firm provides numerous investment services, DIS specializes in portfolio management for individual and institutional clients and only deals in publicly traded debt, equity, and derivative instruments.

Walter Fried, CFA, is a portfolio manager and the director of DIS's offices in Austria. For several years, Fried has maintained a relationship with a local tax consultant. The consultant provides a DIS marketing brochure with Fried's contact information to his clients seeking investment advisory services, and in return.

Fried manages the consultant's personal portfolio and informs the consultant of potential tax issues in the referred clients' portfolios as they occur. Because he cannot personally manage all of the inquiring clients' assets, Fried generally passes the client information along to one of his employees but never discloses his relationship with the tax accountant. Fried recently forwarded information on the prospective Jones Family Trust account to Beverly Ulster, CFA, one of his newly hired portfolio managers.

Upon receiving the information, Ulster immediately set up a meeting with Terrence Phillips, the trustee of the Jones Family Trust. Ulster began the meeting by explaining DIS's investment services as detailed in the firm's approved marketing and public relations literature. Ulster also had Phillips complete a very detailed questionnaire regarding the risk and return objectives, investment constraints, and other information related to the trust beneficiaries, which Phillips is not. While reading the questionnaire, Ulster learned that Phillips heard about DIS's services through a referral from his tax consultant. Upon further investigation, Ulster discovered the agreement set up between Fried and the tax consultant, which is legal according to Austrian law but was not disclosed by either party Ulster took a break from the meeting to get more details from Fried. With full information on the referral arrangement, Ulster immediately makes full disclosure to the Phillips.

Before the meeting with Phillips concluded, Ulster began formalizing the investment policy statement (IPS) for the Jones Family Trust and agreed to Phillips' request that the IPS should explicitly forbid derivative positions in the Trust portfolio.

A few hours after meeting with the Jones Family Trust representative, Ulster accepted another new referral client, Steven West, from Fried. Following DIS policy,

Ulster met with West to address his investment objectives and constraints and explain the firm's services. During the meeting, Ulster informed West that DIS offers three levels of account status, each with an increasing fee based on the account's asset value. The first level has the lowest account fees but receives oversubscribed domestic IPO allocations only after the other two levels receive IPO allocations. The second-level clients have the same priority as third-level clients with respect to oversubscribed domestic IPO allocations and receive research with significantly greater detail than first-level clients. Clients who subscribe to the third level of DIS services receive the most detailed research reports and are allowed to participate in both domestic and international IPOs. All clients receive research and recommendations at approximately the same lime. West decided to engage DIS's services as a second-level client. While signing the enrollment papers, West told Ulster, "If you can give me the kind of performance I am looking for, I may move the rest of my assets to DIS." When Ulster inquired about the other accounts, West would not specify how much or what type of assets he held in other accounts. West also noted that a portion of the existing assets to be transferred to Ulster's control were private equity investments in small start-up companies, which DIS would need to manage. Ulster assured him that DIS would have no problem managing the private equity investments.

After her meeting with West, Ulster attended a weekly strategy session held by DIS. All managers were required to attend this particular meeting since the focus was on a new strategy designed to reduce portfolio volatility while slightly enhancing return using a combination of futures and options on various asset classes.

Intrigued by the idea, Ulster implemented the strategy for all of her clients and achieved positive results for all portfolios. Ulster's average performance results after one year of using the new strategy are presented in Figure 1. For comparative purposes, performance figures without the new strategy are also presented.

At the latest strategy meeting, DIS economists were extremely pessimistic about emerging market economies and suggested that the firm's portfolio managers consider selling emerging market securities out of their portfolios and avoid these investments for the next 12 to 15 months. Fried placed a limit order to sell his personal holdings of an emerging market fund at a price 5% higher than the market price at the time. He then began selling his clients' (all of whom have discretionary accounts with DIS) holdings of the same emerging market fund using market orders. All of his clients' trade orders were completed just before the price of the fund declined sharply by 13%, causing Fried's order to remain unfilled.

According to CFA Institute Standards of Professional Conduct, which of the following statements regarding Ulster's meeting with West is most accurate? Ulster may:

- A. offer the different service levels and may accept the account without full knowledge of West's other accounts.

- B. not offer the different service levels but may accept the account without full knowledge of West's other accounts.

- C. not offer the different service levels and may not accept the account without full knowledge of West's other accounts. B

Answer : Explanation

Explanation:

According to Standard III(B) Fair Dealing, members and candidates must deal fairly with all clients. This applies to recommendations made by the member or candidate and investment action taken by the member or candidate on behalf of the client. Different service levels are acceptable as long as they are offered to all clients. In this scenario, it is not the existence of different service levels that violates Standard 111(B) but the fact that trade allocation policies between the service levels ate unfair. Clients who enroll for the least expensive services are put at a great disadvantage to other clients. Disclosure of the unfair policy does not absolve the member or candidate from their responsibility to treat clients fairly. (Study Session 1, LOS 2.a)

Question 11

Dynamic Investment Services (DIS) is a global, full-service investment advisory firm based in the United States. Although the firm provides numerous investment services, DIS specializes in portfolio management for individual and institutional clients and only deals in publicly traded debt, equity, and derivative instruments.

Walter Fried, CFA, is a portfolio manager and the director of DIS's offices in Austria. For several years, Fried has maintained a relationship with a local tax consultant. The consultant provides a DIS marketing brochure with Fried's contact information to his clients seeking investment advisory services, and in return.

Fried manages the consultant's personal portfolio and informs the consultant of potential tax issues in the referred clients' portfolios as they occur. Because he cannot personally manage all of the inquiring clients' assets, Fried generally passes the client information along to one of his employees but never discloses his relationship with the tax accountant. Fried recently forwarded information on the prospective Jones Family Trust account to Beverly Ulster, CFA, one of his newly hired portfolio managers.

Upon receiving the information, Ulster immediately set up a meeting with Terrence Phillips, the trustee of the Jones Family Trust. Ulster began the meeting by explaining DIS's investment services as detailed in the firm's approved marketing and public relations literature. Ulster also had Phillips complete a very detailed questionnaire regarding the risk and return objectives, investment constraints, and other information related to the trust beneficiaries, which Phillips is not. While reading the questionnaire, Ulster learned that Phillips heard about DIS's services through a referral from his tax consultant. Upon further investigation, Ulster discovered the agreement set up between Fried and the tax consultant, which is legal according to Austrian law but was not disclosed by either party Ulster took a break from the meeting to get more details from Fried. With full information on the referral arrangement, Ulster immediately makes full disclosure to the Phillips.

Before the meeting with Phillips concluded, Ulster began formalizing the investment policy statement (IPS) for the Jones Family Trust and agreed to Phillips' request that the IPS should explicitly forbid derivative positions in the Trust portfolio.

A few hours after meeting with the Jones Family Trust representative, Ulster accepted another new referral client, Steven West, from Fried. Following DIS policy,

Ulster met with West to address his investment objectives and constraints and explain the firm's services. During the meeting, Ulster informed West that DIS offers three levels of account status, each with an increasing fee based on the account's asset value. The first level has the lowest account fees but receives oversubscribed domestic IPO allocations only after the other two levels receive IPO allocations. The second-level clients have the same priority as third-level clients with respect to oversubscribed domestic IPO allocations and receive research with significantly greater detail than first-level clients. Clients who subscribe to the third level of DIS services receive the most detailed research reports and are allowed to participate in both domestic and international IPOs. All clients receive research and recommendations at approximately the same lime. West decided to engage DIS's services as a second-level client. While signing the enrollment papers, West told Ulster, "If you can give me the kind of performance I am looking for, I may move the rest of my assets to DIS." When Ulster inquired about the other accounts, West would not specify how much or what type of assets he held in other accounts. West also noted that a portion of the existing assets to be transferred to Ulster's control were private equity investments in small start-up companies, which DIS would need to manage. Ulster assured him that DIS would have no problem managing the private equity investments.

After her meeting with West, Ulster attended a weekly strategy session held by DIS. All managers were required to attend this particular meeting since the focus was on a new strategy designed to reduce portfolio volatility while slightly enhancing return using a combination of futures and options on various asset classes.

Intrigued by the idea, Ulster implemented the strategy for all of her clients and achieved positive results for all portfolios. Ulster's average performance results after one year of using the new strategy are presented in Figure 1. For comparative purposes, performance figures without the new strategy are also presented.

At the latest strategy meeting, DIS economists were extremely pessimistic about emerging market economies and suggested that the firm's portfolio managers consider selling emerging market securities out of their portfolios and avoid these investments for the next 12 to 15 months. Fried placed a limit order to sell his personal holdings of an emerging market fund at a price 5% higher than the market price at the time. He then began selling his clients' (all of whom have discretionary accounts with DIS) holdings of the same emerging market fund using market orders. All of his clients' trade orders were completed just before the price of the fund declined sharply by 13%, causing Fried's order to remain unfilled.

By utilizing the futures and options strategy as suggested by DIS's economists, did Ulster violate any CFA Institute Standards of Professional Conduct?

- A. Yes.

- B. No, because she acted in her clients best interest by reducing portfolio risk while increasing portfolio return.

- C. No, because she treated all clients fairly by applying the strategy to both individual and institutional clients.

Answer : A

Explanation:

Ulster has failed to recognize chat while the derivative strategy successfully lowered the volatilities of her clients' portfolios and raised the returns, the strategy may not have been suitable for all portfolios. In particular, the Jones Family Trust investment policy statement strictly forbids the use of derivative instruments, and therefore the derivatives strategy is unsuitable for the account. Ulster should not have used the strategy for the Jones Family Trust account or for any other account that would deem the strategy unsuitable and has thus violated Standard III(C) Suitability. (Study Session 1, LOS 2.a)

Question 12

Dynamic Investment Services (DIS) is a global, full-service investment advisory firm based in the United States. Although the firm provides numerous investment services, DIS specializes in portfolio management for individual and institutional clients and only deals in publicly traded debt, equity, and derivative instruments.

Walter Fried, CFA, is a portfolio manager and the director of DIS's offices in Austria. For several years, Fried has maintained a relationship with a local tax consultant. The consultant provides a DIS marketing brochure with Fried's contact information to his clients seeking investment advisory services, and in return.

Fried manages the consultant's personal portfolio and informs the consultant of potential tax issues in the referred clients' portfolios as they occur. Because he cannot personally manage all of the inquiring clients' assets, Fried generally passes the client information along to one of his employees but never discloses his relationship with the tax accountant. Fried recently forwarded information on the prospective Jones Family Trust account to Beverly Ulster, CFA, one of his newly hired portfolio managers.

Upon receiving the information, Ulster immediately set up a meeting with Terrence Phillips, the trustee of the Jones Family Trust. Ulster began the meeting by explaining DIS's investment services as detailed in the firm's approved marketing and public relations literature. Ulster also had Phillips complete a very detailed questionnaire regarding the risk and return objectives, investment constraints, and other information related to the trust beneficiaries, which Phillips is not. While reading the questionnaire, Ulster learned that Phillips heard about DIS's services through a referral from his tax consultant. Upon further investigation, Ulster discovered the agreement set up between Fried and the tax consultant, which is legal according to Austrian law but was not disclosed by either party Ulster took a break from the meeting to get more details from Fried. With full information on the referral arrangement, Ulster immediately makes full disclosure to the Phillips.

Before the meeting with Phillips concluded, Ulster began formalizing the investment policy statement (IPS) for the Jones Family Trust and agreed to Phillips' request that the IPS should explicitly forbid derivative positions in the Trust portfolio.

A few hours after meeting with the Jones Family Trust representative, Ulster accepted another new referral client, Steven West, from Fried. Following DIS policy,

Ulster met with West to address his investment objectives and constraints and explain the firm's services. During the meeting, Ulster informed West that DIS offers three levels of account status, each with an increasing fee based on the account's asset value. The first level has the lowest account fees but receives oversubscribed domestic IPO allocations only after the other two levels receive IPO allocations. The second-level clients have the same priority as third-level clients with respect to oversubscribed domestic IPO allocations and receive research with significantly greater detail than first-level clients. Clients who subscribe to the third level of DIS services receive the most detailed research reports and are allowed to participate in both domestic and international IPOs. All clients receive research and recommendations at approximately the same lime. West decided to engage DIS's services as a second-level client. While signing the enrollment papers, West told Ulster, "If you can give me the kind of performance I am looking for, I may move the rest of my assets to DIS." When Ulster inquired about the other accounts, West would not specify how much or what type of assets he held in other accounts. West also noted that a portion of the existing assets to be transferred to Ulster's control were private equity investments in small start-up companies, which DIS would need to manage. Ulster assured him that DIS would have no problem managing the private equity investments.

After her meeting with West, Ulster attended a weekly strategy session held by DIS. All managers were required to attend this particular meeting since the focus was on a new strategy designed to reduce portfolio volatility while slightly enhancing return using a combination of futures and options on various asset classes.

Intrigued by the idea, Ulster implemented the strategy for all of her clients and achieved positive results for all portfolios. Ulster's average performance results after one year of using the new strategy are presented in Figure 1. For comparative purposes, performance figures without the new strategy are also presented.

At the latest strategy meeting, DIS economists were extremely pessimistic about emerging market economies and suggested that the firm's portfolio managers consider selling emerging market securities out of their portfolios and avoid these investments for the next 12 to 15 months. Fried placed a limit order to sell his personal holdings of an emerging market fund at a price 5% higher than the market price at the time. He then began selling his clients' (all of whom have discretionary accounts with DIS) holdings of the same emerging market fund using market orders. All of his clients' trade orders were completed just before the price of the fund declined sharply by 13%, causing Fried's order to remain unfilled.

According to CFA Institute Standards of Professional Conduct, should Fried have taken a different course of action with respect to the limit order on the emerging market fund?

- A. No.

- B. Yes, Fried should not have sold any shares of the emerging market fund.

- C. Yes, Fried should have waited to place the limit order until after the market orders were filled.

Answer : C

Explanation:

Fried has violated Standard VI(B) Priority of Transactions by placing his own sell order ahead of his clients' sell orders. Even though Fried has used a limit order with a 5% premium to the current stock price (and his order never gets executed), he has still acted in his own interest before acting in his clients' interest. Fried should have placed his clients' trades before placing his own. (Study Session 1, LOS 2.a)

Question 13

Shirley Riley, CFA, has just been promoted, from vice president of trading to chief investment officer (CIO) at Crane & Associates, LLC (CA), a large investment management firm. Riley has been with CA for eight years, but she has much to learn as she assumes her new duties as CIO. Riley has decided to hire Denny

Simpson, CFA, as the new compliance officer for CA, Riley and Simpson have been reviewing procedures and policies throughout the firm and have discovered several potential issues.

Communications with Clients -

Portfolio managers are encouraged to communicate with clients on a regular basis. At a minimum, managers are expected to contact clients on a quarterly basis to review portfolio performance. Each client must have an investment policy statement (IPS) created when their account is opened, specifying the objectives and constraints for their portfolio. IPSs are reviewed at client request at any time. Any time market conditions dictate a change in the investment style or strategy of a client portfolio, the client is notified immediately by phone or email.

Employee Incentive Program -

CA offers several incentive programs to employees. One of the most popular of these programs is the CA IPO program. Whenever CA is involved in an initial public offering (IPO), portfolio managers are allowed to participate. The structure is simple""for every 100 shares purchased on behalf of a client, the manager is awarded five shares for his own account. The manager is thus rewarded for getting an IPO sold and at the same time is able to share in the results of the IPO.

Any¬time shares are remaining 72 hours before the IPO goes public, other employees are allowed to participate on a first-come, first-serve basis. Employees seem to appreciate this opportunity, but CA does not have exact numbers on employee participation in the program.

Private Equity Fund -

CA has a private equity fund that is internally managed. This fund is made available only to clients with more than $5 million in assets managed by CA, a policy that is fully disclosed in CA's marketing materials. Roughly one-third of the fund's assets are invested in companies that are either very small capitalization or thinly traded (or both). The pricing of these securities for monthly account statements is often difficult. CA support staff get information from different sources"" sometimes using third party services, sometimes using CA valuation models. In some instances, a manager of the private equity fund will enter an order during the last trading hour of the month to purchase 100 shares of one of these small securities at a modest premium to the last trade price. If the trade gets executed, that price can then be used on the account statements. The small size of these trades does not significantly affect the fund's overall position in any particular company holding, which is typically several thousand shares.

Soft Dollar Usage -

Several different managers at CA use independent research in developing investment ideas. One of the more popular research services among CA managers is

"Beneath the Numbers (BTN)," which focuses on potential accounting abuses at prominent companies. This service often provides early warnings of problems with a stock, allowing CA managers the opportunity to sell their clients' positions before a negative surprise lowers the price. Stocks covered by BTN are typically widely held in CA client accounts. Managers at CA have been so happy with BTN that they have also subscribed to a new research product provided by the same authors"""Beneath the Radar (BTR)." BTR recommends small capitalization securities that are not large enough to attract much attention from large institutional investors. The results of BTR's recommendations are mixed thus far, but CA managers are willing to be patient.

As they discuss these issues, Riley informs Simpson that she is determined to bring CA into full compliance with the CFA Institute's "Asset Manager Code of

Professional Conduct." The following questions should be answered with the Asset Manager Code as a guide.

Indicate whether CA's policies related to investment policy statement (IPS) reviews and notification of changes in investment style/strategy are consistent with the

Asset Manager Code of Professional Conduct.

- A. The IPS review policy is adequate, but the policy on communicating changes in style / strategy is inadequate.

- B. Both policies are inadequate.

- C. Both policies are consistent with the Asset Manager Code of Professional Conduct.

Answer : B

Explanation:

The IPS review policy is inadequate. It is good that IPS are reviewed at any lime upon client request, but it is also likely that clients may be unaware of when such a review might be appropriate. It is incumbent upon the manager 10 initiate a review of the client's IPS. The Asset Manager Code recommends such reviews on an annual basis, or whenever changes in client circumstances justify them. The notification of changes in style/strategy is also inadequate. Such notification should be made in advance, so that the client has time to consider the change and react accordingly. (Study Session 2, LOS 6.b)

Question 14

Shirley Riley, CFA, has just been promoted, from vice president of trading to chief investment officer (CIO) at Crane & Associates, LLC (CA), a large investment management firm. Riley has been with CA for eight years, but she has much to learn as she assumes her new duties as CIO. Riley has decided to hire Denny

Simpson, CFA, as the new compliance officer for CA, Riley and Simpson have been reviewing procedures and policies throughout the firm and have discovered several potential issues.

Communications with Clients -

Portfolio managers are encouraged to communicate with clients on a regular basis. At a minimum, managers are expected to contact clients on a quarterly basis to review portfolio performance. Each client must have an investment policy statement (IPS) created when their account is opened, specifying the objectives and constraints for their portfolio. IPSs are reviewed at client request at any time. Any time market conditions dictate a change in the investment style or strategy of a client portfolio, the client is notified immediately by phone or email.

Employee Incentive Program -

CA offers several incentive programs to employees. One of the most popular of these programs is the CA IPO program. Whenever CA is involved in an initial public offering (IPO), portfolio managers are allowed to participate. The structure is simple""for every 100 shares purchased on behalf of a client, the manager is awarded five shares for his own account. The manager is thus rewarded for getting an IPO sold and at the same time is able to share in the results of the IPO.

Any¬time shares are remaining 72 hours before the IPO goes public, other employees are allowed to participate on a first-come, first-serve basis. Employees seem to appreciate this opportunity, but CA does not have exact numbers on employee participation in the program.

Private Equity Fund -

CA has a private equity fund that is internally managed. This fund is made available only to clients with more than $5 million in assets managed by CA, a policy that is fully disclosed in CA's marketing materials. Roughly one-third of the fund's assets are invested in companies that are either very small capitalization or thinly traded (or both). The pricing of these securities for monthly account statements is often difficult. CA support staff get information from different sources"" sometimes using third party services, sometimes using CA valuation models. In some instances, a manager of the private equity fund will enter an order during the last trading hour of the month to purchase 100 shares of one of these small securities at a modest premium to the last trade price. If the trade gets executed, that price can then be used on the account statements. The small size of these trades does not significantly affect the fund's overall position in any particular company holding, which is typically several thousand shares.

Soft Dollar Usage -

Several different managers at CA use independent research in developing investment ideas. One of the more popular research services among CA managers is

"Beneath the Numbers (BTN)," which focuses on potential accounting abuses at prominent companies. This service often provides early warnings of problems with a stock, allowing CA managers the opportunity to sell their clients' positions before a negative surprise lowers the price. Stocks covered by BTN are typically widely held in CA client accounts. Managers at CA have been so happy with BTN that they have also subscribed to a new research product provided by the same authors"""Beneath the Radar (BTR)." BTR recommends small capitalization securities that are not large enough to attract much attention from large institutional investors. The results of BTR's recommendations are mixed thus far, but CA managers are willing to be patient.

As they discuss these issues, Riley informs Simpson that she is determined to bring CA into full compliance with the CFA Institute's "Asset Manager Code of

Professional Conduct." The following questions should be answered with the Asset Manager Code as a guide.

Indicate whether CA's policies related to its IPO program, specifically allowing portfolio manager participation and employee participation, are consistent with the

Asset Manager Code of Professional Conduct.

- A. Policies on both portfolio manager and employee participation in IPOs are not consistent with the Asset Manager Code of Professional Conduct.

- B. The employee participation in IPOs policy is consistent with the Asset Manager Code, as is the portfolio manager's policy on participation in IPOs.

- C. The portfolio manager's policy on IPOs is not consistent with the Asset Manager Code, however the employee policy on IPOs is consistent with the Asset Manager Code.

Answer : A

Explanation:

The IPO program creates a substantial conflict of interest between managers and clients. Managers wanting to boost their participation in an IPO would be likely to place orders in accounts where such an investment might not be appropriate. The employee participation in and of itself might be acceptable, so long as clients' interests were placed ahead of employees'. In this case, there is no evidence of such a priority of transactions, and further, the fact that CA has no exact numbers on the program indicates that the firm is not tracking employee trading activity, which is poor policy. (Study Session 2, LOS 6.b)

Question 15

Shirley Riley, CFA, has just been promoted, from vice president of trading to chief investment officer (CIO) at Crane & Associates, LLC (CA), a large investment management firm. Riley has been with CA for eight years, but she has much to learn as she assumes her new duties as CIO. Riley has decided to hire Denny

Simpson, CFA, as the new compliance officer for CA, Riley and Simpson have been reviewing procedures and policies throughout the firm and have discovered several potential issues.

Communications with Clients -

Portfolio managers are encouraged to communicate with clients on a regular basis. At a minimum, managers are expected to contact clients on a quarterly basis to review portfolio performance. Each client must have an investment policy statement (IPS) created when their account is opened, specifying the objectives and constraints for their portfolio. IPSs are reviewed at client request at any time. Any time market conditions dictate a change in the investment style or strategy of a client portfolio, the client is notified immediately by phone or email.

Employee Incentive Program -

CA offers several incentive programs to employees. One of the most popular of these programs is the CA IPO program. Whenever CA is involved in an initial public offering (IPO), portfolio managers are allowed to participate. The structure is simple""for every 100 shares purchased on behalf of a client, the manager is awarded five shares for his own account. The manager is thus rewarded for getting an IPO sold and at the same time is able to share in the results of the IPO.

Any¬time shares are remaining 72 hours before the IPO goes public, other employees are allowed to participate on a first-come, first-serve basis. Employees seem to appreciate this opportunity, but CA does not have exact numbers on employee participation in the program.

Private Equity Fund -

CA has a private equity fund that is internally managed. This fund is made available only to clients with more than $5 million in assets managed by CA, a policy that is fully disclosed in CA's marketing materials. Roughly one-third of the fund's assets are invested in companies that are either very small capitalization or thinly traded (or both). The pricing of these securities for monthly account statements is often difficult. CA support staff get information from different sources"" sometimes using third party services, sometimes using CA valuation models. In some instances, a manager of the private equity fund will enter an order during the last trading hour of the month to purchase 100 shares of one of these small securities at a modest premium to the last trade price. If the trade gets executed, that price can then be used on the account statements. The small size of these trades does not significantly affect the fund's overall position in any particular company holding, which is typically several thousand shares.

Soft Dollar Usage -

Several different managers at CA use independent research in developing investment ideas. One of the more popular research services among CA managers is

"Beneath the Numbers (BTN)," which focuses on potential accounting abuses at prominent companies. This service often provides early warnings of problems with a stock, allowing CA managers the opportunity to sell their clients' positions before a negative surprise lowers the price. Stocks covered by BTN are typically widely held in CA client accounts. Managers at CA have been so happy with BTN that they have also subscribed to a new research product provided by the same authors"""Beneath the Radar (BTR)." BTR recommends small capitalization securities that are not large enough to attract much attention from large institutional investors. The results of BTR's recommendations are mixed thus far, but CA managers are willing to be patient.

As they discuss these issues, Riley informs Simpson that she is determined to bring CA into full compliance with the CFA Institute's "Asset Manager Code of

Professional Conduct." The following questions should be answered with the Asset Manager Code as a guide.

Participation in CA's private equity fund is limited to clients with $5 million under management. This policy:

- A. docs not violate the Asset Manager Code of Professional Conduct.

- B. would be acceptable so long as a similar investment vehicle was made available to all clients.

- C. is not consistent with the Asset Manager Code of Professional Conduct.

Answer : A

Explanation:

It is perfectly reasonable for CA to offer certain services or products only to clients meeting specified criteria, such as assets under management. (Study Session

2, LOS 6.b)